Table of Contents

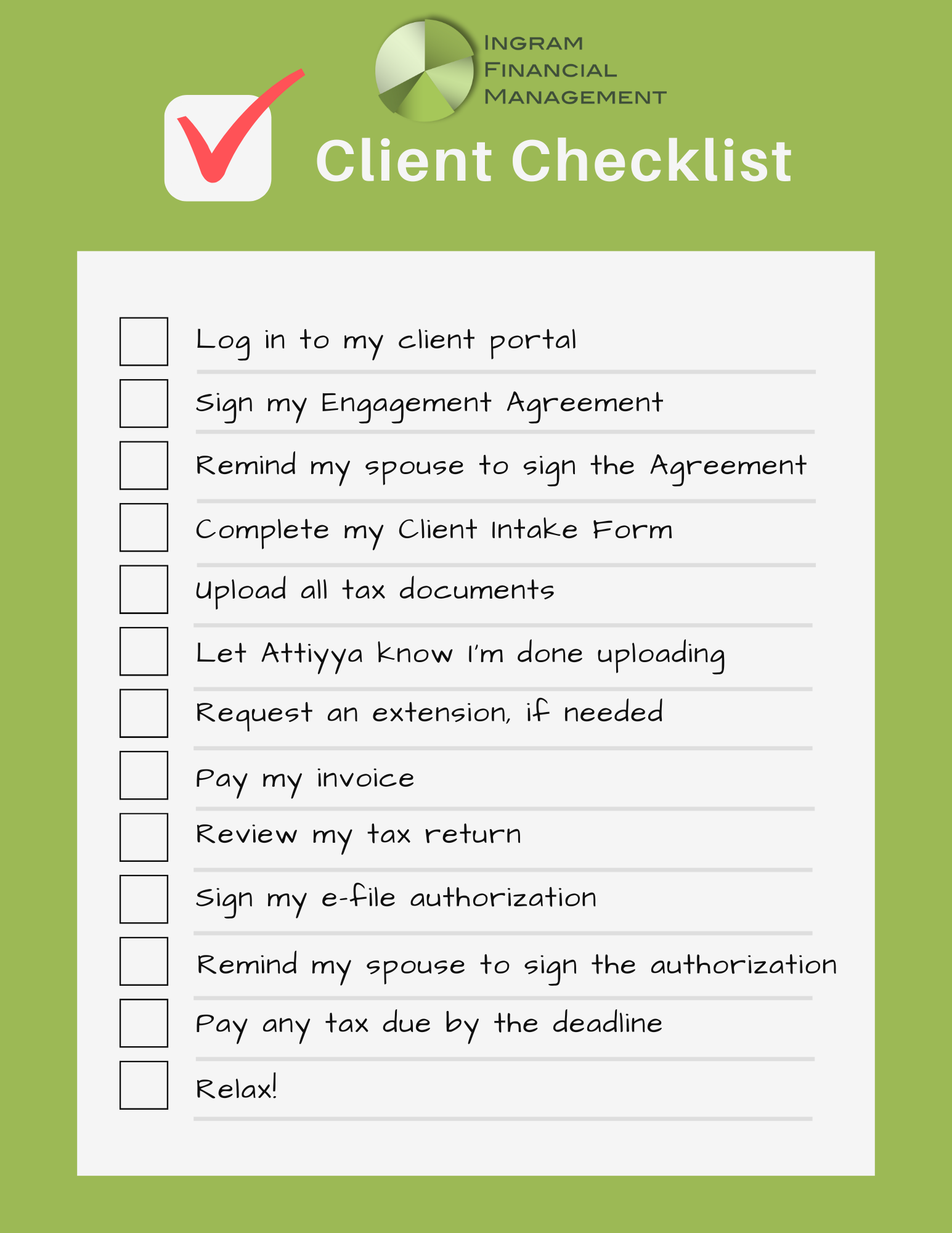

- Tax Form Checklist 2023 - Printable Forms Free Online

- Eligibility Criteria For Child Tax Credit 2024 Calculator - Edee Nertie

- Arnold Strongman Classic 2025 Winner - Silke Ehrlichmann

- Bmw Championship 2025 Tee Times - Minna Sydelle

- Efficient Tax Preparation With H&R Block Checklist Excel Template And ...

- Free Printable Download! Your Ultimate Simple Tax Preparation Checklist ...

- Key 2021 tax deadlines & check list for real estate investors - Stessa ...

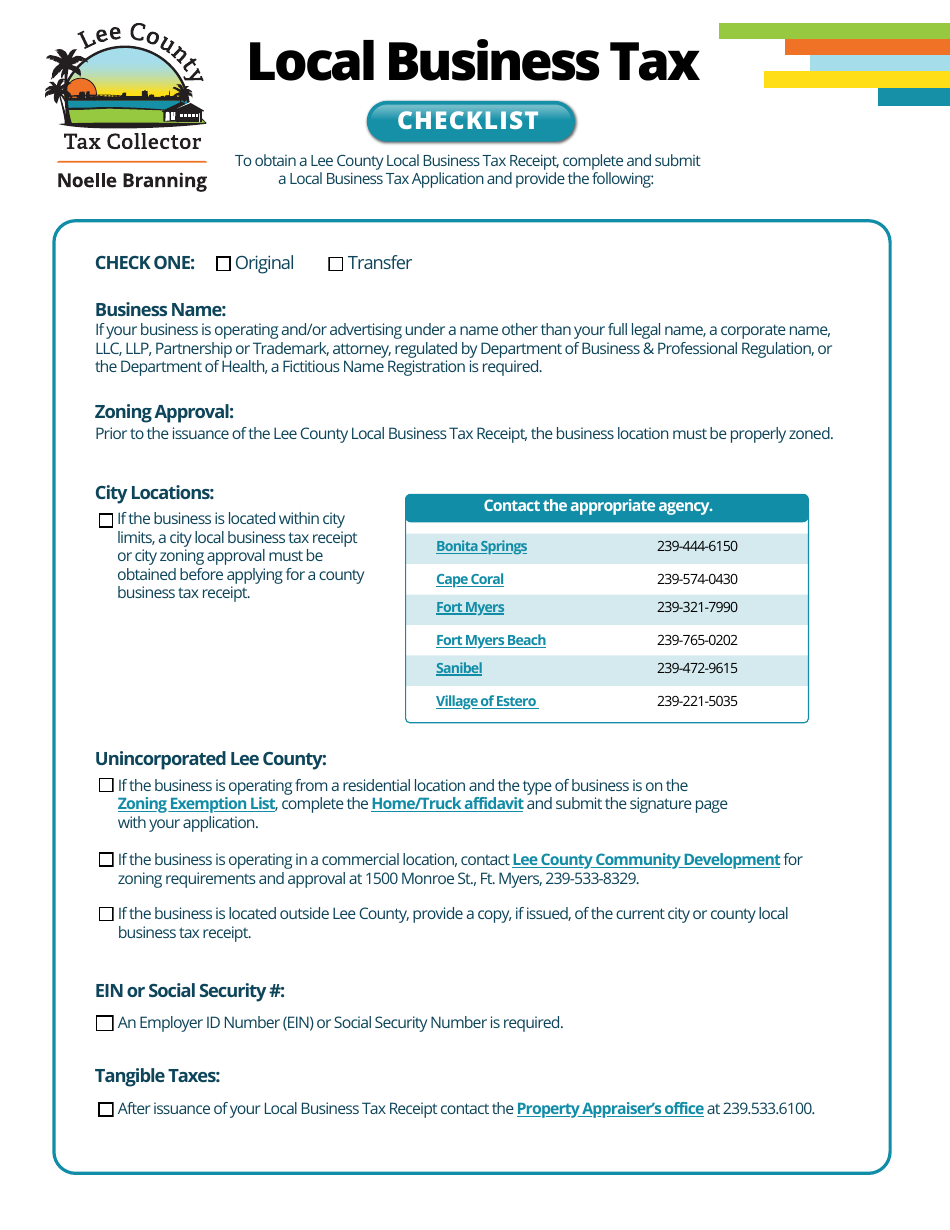

- Lee County, Florida Local Business Tax Checklist - Fill Out, Sign ...

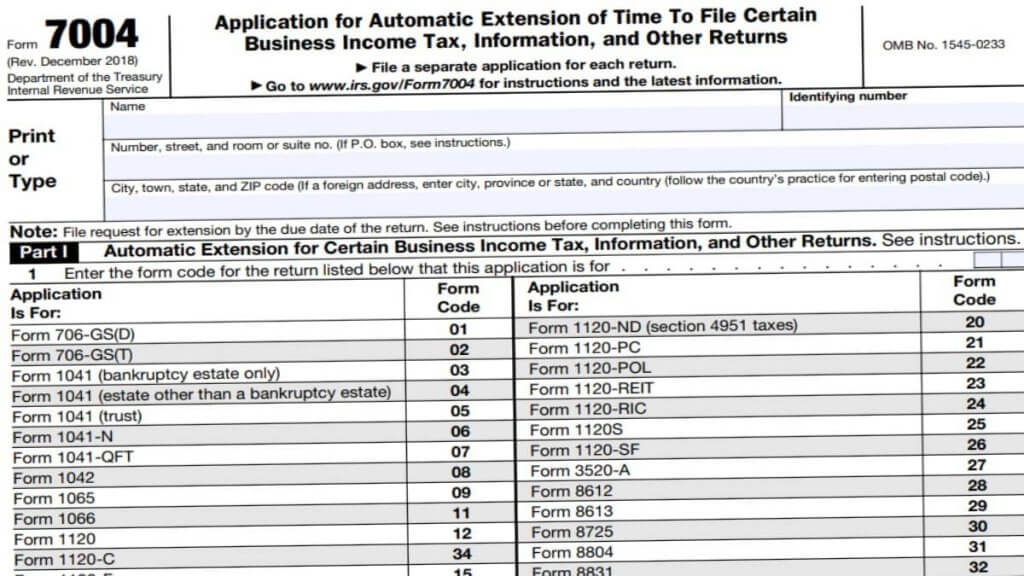

- Tax Deadline 2024 Extension Form 2024 - Meade Jocelyn

- Efficient Checklist For Tax Preparation 2024 Excel Template And Google ...

Why Gather Documents?

- Accurate Tax Filing: Providing accurate information is vital to avoid errors, audits, or even penalties.

- Maximize Refund: Gathering all the necessary documents can help you claim the maximum refund you're eligible for.

- Reduce Stress: Having all the documents in one place can reduce stress and anxiety during the tax filing process.

Documents to Gather

- Income Documents:

- W-2 forms from your employer

- 1099 forms for freelance or contract work

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Deduction Documents:

- Receipts for charitable donations

- Medical expense receipts

- Mortgage interest statements (1098)

- Property tax statements

- Credit Documents:

- Child care expense receipts

- Education expense receipts

- Retirement account contributions

Tips for Staying Organized

- Create a Folder: Designate a folder or file to store all your tax-related documents.

- Scan Documents: Scan your documents and save them digitally to reduce clutter and make them easily accessible.

- Use Tax Software: Utilize tax software like TurboTax or H&R Block to guide you through the filing process and ensure accuracy.

By following this guide, you'll be well-prepared to tackle the tax filing process with confidence. Stay organized, and you'll be on your way to a stress-free tax season.