Table of Contents

- MASSIVE 401k RULE CHANGE COMING | Mandatory 50+ Catch Up Contributions ...

- IRS Delays Secure 2.0 Mandatory 401k Catch-up Contributions until 2026 ...

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- Changes to 401(k) Contribution Limits for 2020 | ConnectPay

- How Much Should I Contribute to My 401(k)?

- Mandatory 401(k) Roth Contributions Under the SECURE Act 2.0

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

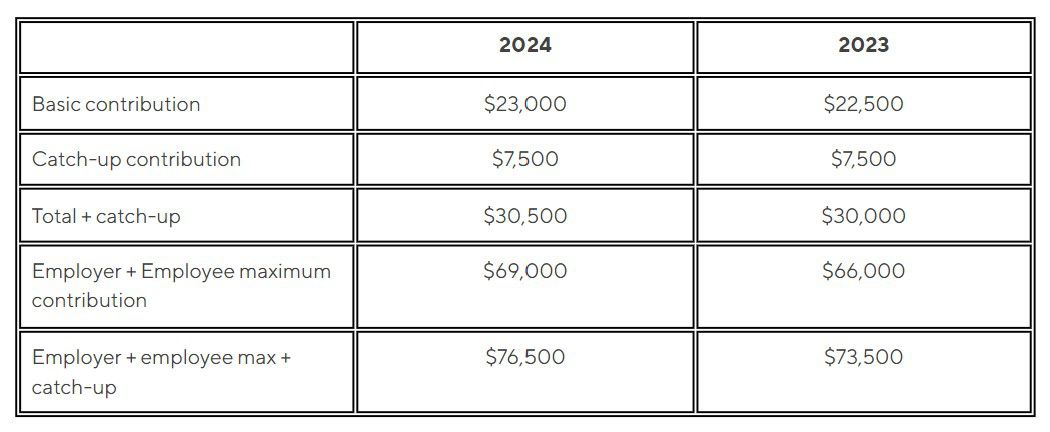

- 401(k) Contribution Limits In 2024 And 2025 | Bankrate

- 2021 401(k) Contribution Limits, Rules, and More

- 401(k) Contribution Limits 2021

Background on Roth Catch-Up Contributions

Administrative Transition Period

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

Key Provisions of the Transition Period

The transition period provides relief in several areas, including: Eligibility criteria: The IRS will not enforce the new eligibility criteria for Roth catch-up contributions during the transition period. This means that individuals who were eligible for Roth catch-up contributions under the old rules can continue to make contributions until the end of the transition period. Contribution limits: The IRS will not impose penalties on individuals or employers who exceed the new contribution limits during the transition period. However, taxpayers and employers are still required to report excess contributions and pay any applicable taxes. Plan amendments: Employers are not required to amend their retirement plans to reflect the new rules until the end of the transition period. However, employers are still required to operate their plans in accordance with the new rules.

Implications for Taxpayers and Employers

The administrative transition period provides welcome relief to taxpayers and employers who are struggling to adapt to the new Roth catch-up contribution rules. The transition period gives individuals and businesses time to review their retirement plans and make necessary adjustments to ensure compliance with the new rules. It is essential for taxpayers and employers to take advantage of the transition period to avoid potential penalties and ensure that they are in compliance with the new rules. The IRS announcement of an administrative transition period for the new Roth catch-up contribution rules is a significant development for taxpayers and employers. The transition period provides relief and flexibility, allowing individuals and businesses to adjust to the changes without facing penalties. As the transition period comes to an end, it is crucial for taxpayers and employers to review their retirement plans and ensure compliance with the new rules. By doing so, individuals and businesses can avoid potential penalties and ensure that they are taking advantage of the benefits offered by Roth catch-up contributions.For more information on the new Roth catch-up contribution rules and the administrative transition period, please visit the IRS website or consult with a qualified tax professional.